Extended vehicle coverage made simple for smart drivers

Stretch your budget without gambling on big repairs. With extended vehicle coverage, you target the parts most likely to fail after the factory warranty ends, while keeping premiums and deductibles in balance. Focus on accessibility: clear terms, easy claims, and support you can actually reach.

How to choose, step by step

- Map your risk: Check your model's common failures and mileage trends.

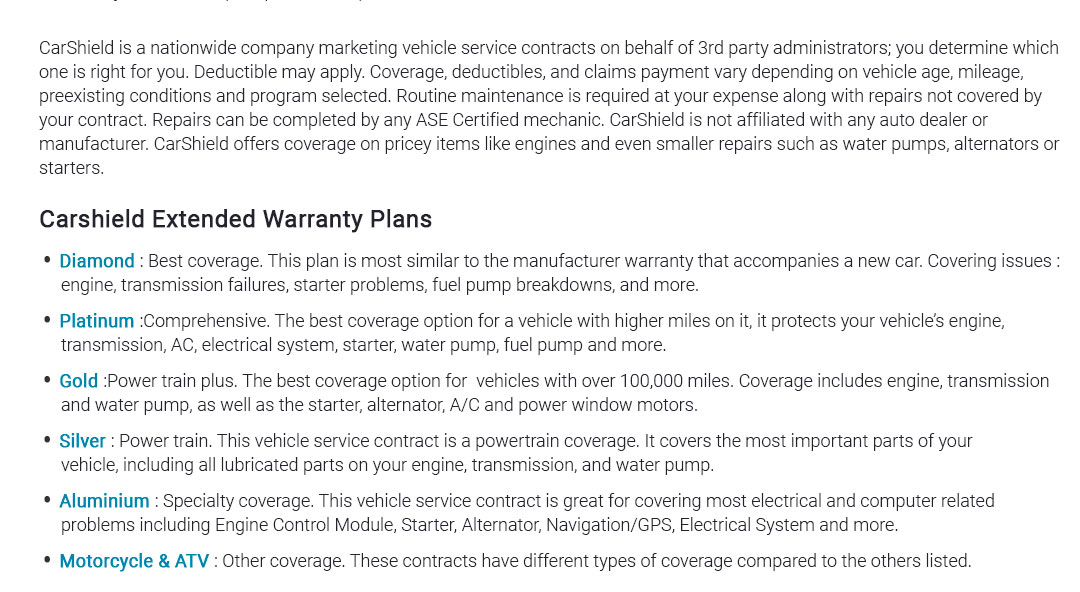

- Scope the parts: Prefer exclusionary plans; they list what's not covered.

- Right-size the deductible: Higher deductibles lower monthly cost - run the math on a likely repair.

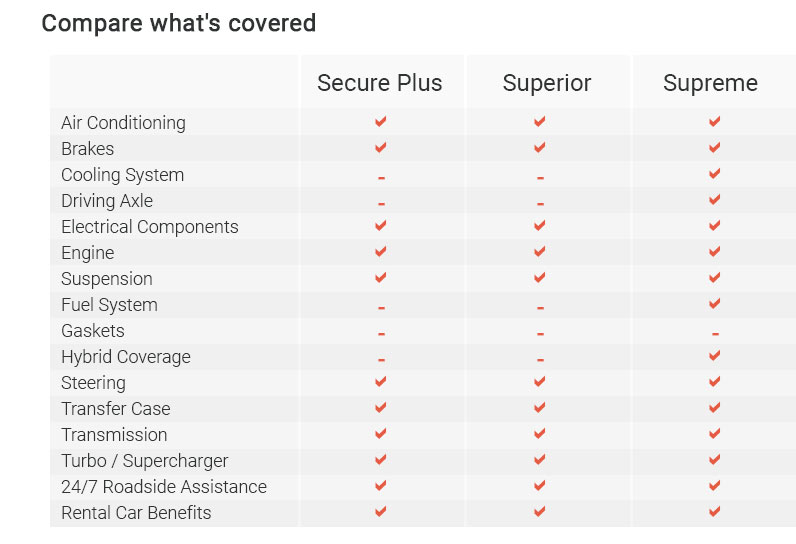

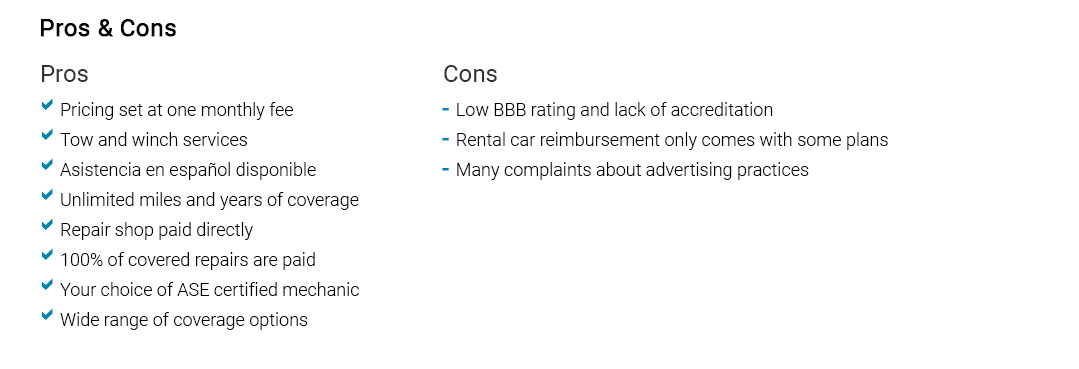

- Verify extras: Roadside, rental car, and trip interruption can soften surprises.

- Confirm network: Choose plans that let you use qualified, nearby shops.

Real moment: a dashboard warning light pops up 200 miles into a family trip. You call the 24/7 line, tow to an ASE shop, and the alternator gets covered - hotel and rental reimbursed capped by policy limits.

Pragmatic caveat

- Coverage isn't a cure-all: wear-and-tear, maintenance items, and pre-existing issues are often excluded.

- Keep service records; approvals may hinge on documented maintenance.

- Some repairs need pre-authorization - call before the wrench turns.

Prefer flexibility? Compare term length, transferability, and cancellation windows, then choose the leanest plan that still protects your real risks.